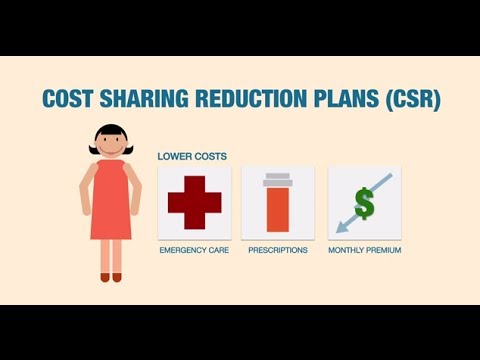

The Marketplace cost-sharing reduction lowers the amount you have to pay for out-of-pocket costs like deductibles, coinsurance, and copayments. Visit HealthCare.gov to see if you can get coverage outside Open Enrollment: http://hlthc.re/R6AlFe

Tag: health insurance

Oscar Health Insurance: Grizzly Bear

Beware of bears, not your health insurance company. We're Oscar a new kind of health insurance company, built for New Yorkers. Check us out at: https://www.hioscar.com/ or call for more information 1-855-OSCAR-NY

¿Habla Español? Nosotros también: http://holaoscar.com

Like us on Facebook:

https://www.facebook.com/OscarHealth

Follow us on Twitter:

Tweets by OscarHealth

Oscar's goal is to change the way consumers interact with healthcare through technology, design and data, featuring easy to understand language and interactive digital tools. By doing so, Oscar is making healthcare simpler, more intuitive, and accessible.

Oscar personalizes the health care experience. Our plans include complimentary, 24/7/365 unlimited telemedicine visits, up to 3 free free Primary Care Physician visits per year in addition to free wellness check-ups, and no-cost generic prescriptions. Oscar currently offers individual plans through the New York State of Health Benefit Exchange.

Best Tips for Health Insurance Savings

1,642 Health Related PLR Articles SAVE $$$ on Health Care

Health Insurance Quotes & Health Insurance Advice

http://chooseyourhealthinsurance.co.uk/ Health Insurance: Don't go direct to an insurer. A specialist & experienced broker will save money & get the best deal for YOU.

Private health insurance enables you to receive prompt treatment when you're feeling ill. If you suffer from an acute condition (a disease, injury or illness that will respond quickly to treatment and allow you to return to your previous state of health) your health insurance policy is designed to specifically treat these conditions if they start after your policy has begun. Some health insurance policies offer extra benefits on top of your standard cover, make sure that you are aware of these to get the most out of your health insurance.

Health insurance doesn't just offer you the opportunity to receive treatment promptly, you can often choose a hospital that is suitable for you at a time and date that is convenient to you. Health insurance providers give you access to a list of hospitals to let you make an informed choice.

The type of individual health insurance cover, the price you pay, and whether you are eligible for cover are dictated by your current state of health. Your gender, age, occupation, residence and medical history are all taken into account by health insurers when they are deciding whether they are able to offer you a policy. Usually, older and sicker individuals will pay more for their health insurance cover in comparison to young and healthy individuals. It can be the case that pre-existing medical conditions are excluded from your health insurance cover, it is important that you are aware of this and understand the limits in place regarding any pre-existing health conditions you may have.

An offer of health insurance may not be made if you currently have or have had a serious health condition, for example cancer or diabetes. With less severe health conditions, for example knee problems or hypertension, you may be offered a health insurance policy with a temporary or permanent exclusion. This means your specific health condition will not be included in the cover. However, some insurers may include your specific condition in their health insurance cover, but the price of the policy will greatly increase.

It is vitally important to understand exactly what is covered in your health insurance policy and what isn't. Each individual policy varies greatly, so you need to be clear on what is and isn't covered in your health insurance policy.

As always, you need to read the fine print of your health insurance policy. Some give you coverage for catastrophes only, and some policies cover you for a specific disease only. Make sure you thoroughly understand what it is you are paying for by knowing exactly what is covered in your health insurance policy — it is not enough to just read the cover summary or benefits list on the health insurers website. Before you purchase your health insurance policy make sure you

have read the full policy wording, this is where you will find all the details on what is covered and what isn't. If there is something you do not understand, ask your potential health insurer and find out. That way, there will be no nasty surprises when you do come to make a health insurance claim.

For older individuals, your health insurance cover may cease when you reach a certain age. Some health insurers will not renew any health insurance policy for anyone over the age of 65 or 70. If you are around 60 years old, check with your health insurance company and find out how long they will cover you for.

If you have got married, or have given birth or adopted, you may want to add a spouse or child to your health insurance policy. With some private health insurers you will be required to re-apply for your health insurance cover so that all members of your family are included. When purchasing your health insurance initially, check with the company if there are any circumstances in which you would need to re-apply.

It is important not to be sucked in solely by the offer of low premiums when choosing your health insurance. Other factors need to be taken into account, mainly the combination of premium and the estimated out-of-pocket spending on health care below the deductible. It is good to remember that all of these outstanding costs are paid for out of your own pocket, so however tempting it may be, do not allow yourself to be sold on premium alone.

A good way of calculating your health costs is to add up all of your potential costs under a health insurance policy. This includes co-payments, deductibles, co-insurance and any other cost-sharing obligations. Your costs will include low limits. This means if you have a £5000 operation, your health insurance policy may have a general limit, or a limit of that specific type of procedure of, say, £3000. Therefore, the outstanding £2000 will be coming out of your pocket. You will not get any money back if the operation costs less than the limit.