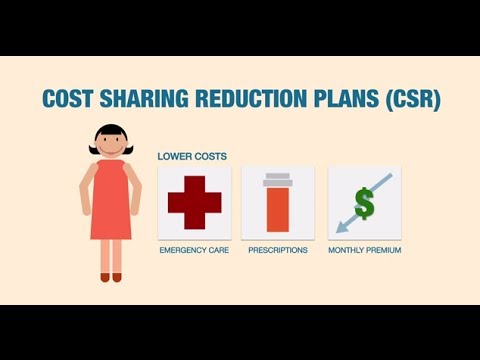

The Marketplace cost-sharing reduction lowers the amount you have to pay for out-of-pocket costs like deductibles, coinsurance, and copayments. Visit HealthCare.gov to see if you can get coverage outside Open Enrollment: http://hlthc.re/R6AlFe

Tag: health plan

Best individual health insurance policy in india

Neelam | Ludhiana

Q:

I request u to suggest me a beneficial health policy. My DOB is 14 5 68 – I want a individual policy My annual income is about 6 lakh I also want a plan for my parents above 65 age. Please suggest me through mail.

Ans:

For you – there are many policies in the market. You could just go online and buy any of the policies. Companies like Bharti AXA, Religare, L&T, Max Bupa – all have good plans.

A cover of 3 lac should cost you anywhere between – Rs.3,700 to Rs.5,000 annually.

Your age is 45 currently so companies will issue you the policy online without any medical check up.

Most of the companies make the medical check compulsory on or after the age of 46.

For your parents, you can look at plans designed for senior citizens

Apollo Munich Optima Senior

United India Senior Citizen

Oriental India Senior Citizen

Take an individual policy for your parents – one policy for each of them. The premium for one person of age 65 should be around Rs.10,000 to Rs.14,000 depending on the company.

https://www.youtube.com/watch?v=463AihVIZ-U

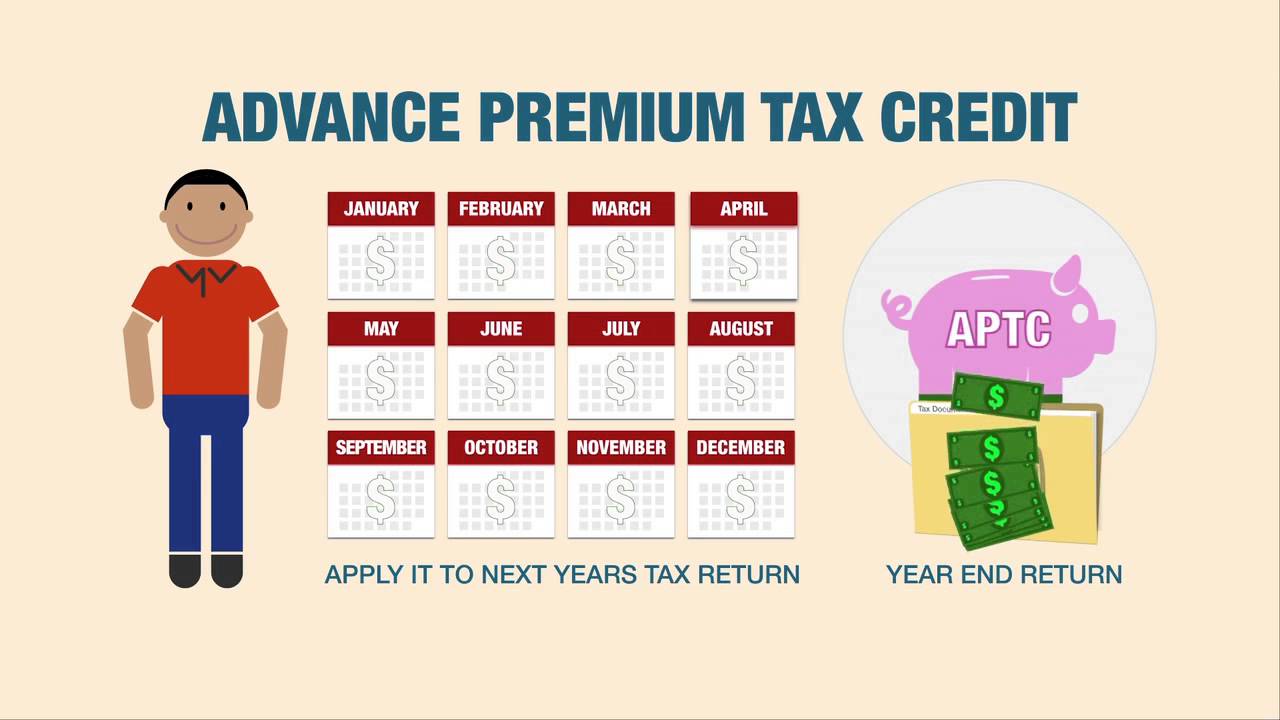

Get lower costs on monthly premiums in the Health Insurance Marketplace

You may be able to get lower costs on monthly premiums. These lower costs are handled with a tax credit called the Advance Premium Tax Credit. But these tax credits can be applied directly to your monthly premiums, so you get the lower costs immediately. Visit HealthCare.gov to see if you can get coverage outside Open Enrollment: http://hlthc.re/R6AlFe

How to choose a plan in the Health Insurance Marketplace

When you compare Marketplace insurance plans, they're put into 5 categories based on how you and the plan can expect to share the costs of care: Bronze, Silver, Gold, Platinum, and Catastrophic. The category you choose affects how much your premium costs each month and what portion of the bill you pay for things like hospital visits or prescription medications. Visit HealthCare.gov to see if you can get coverage outside Open Enrollment: http://hlthc.re/R6AlFe