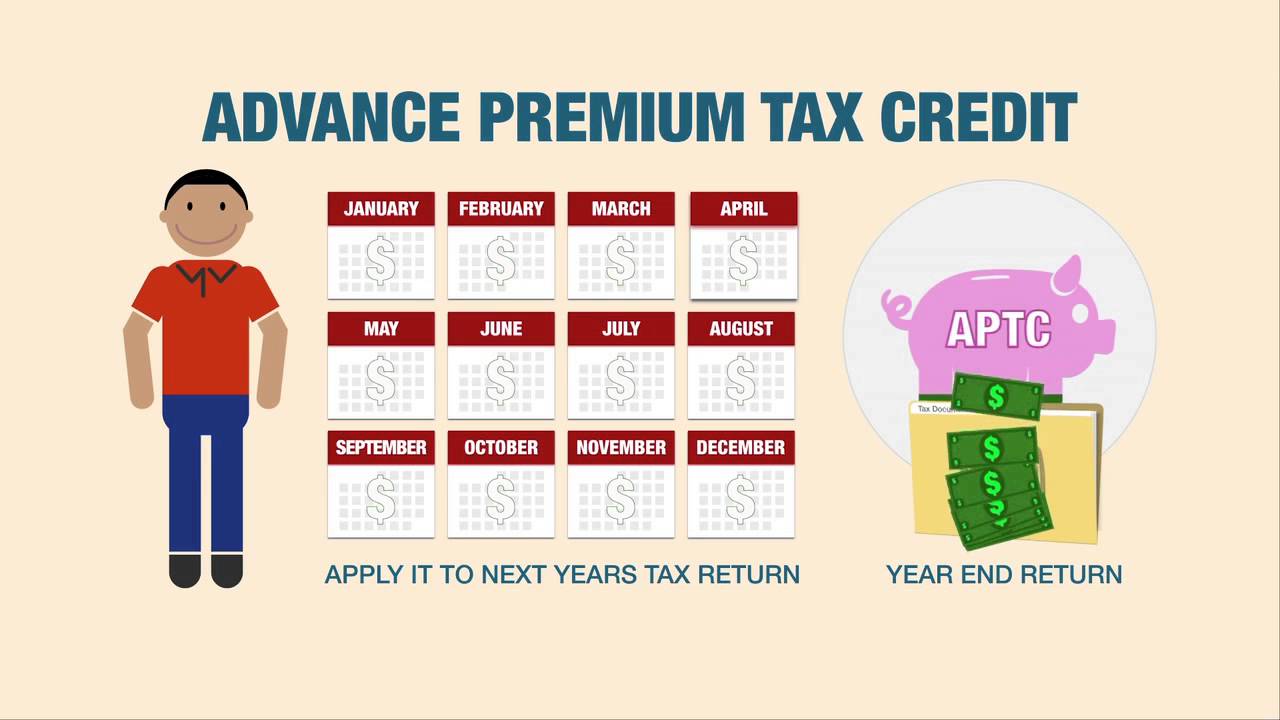

You may be able to get lower costs on monthly premiums. These lower costs are handled with a tax credit called the Advance Premium Tax Credit. But these tax credits can be applied directly to your monthly premiums, so you get the lower costs immediately. Visit HealthCare.gov to see if you can get coverage outside Open Enrollment: http://hlthc.re/R6AlFe

Tag: health insurance

How Health Insurance Works

When I consider purchasing an individual health insurance plan for myself or my family, do I have any financial obligations beyond the monthly premium and annual deductible?

Answers: It depends on the plan, but some plans have the following cost-sharing elements that you should be aware of.

Co-Payments: Some plans include a co-payment, which is typically a specific flat fee you pay for each medical service, such as $30 for an office visit. After the co-payment is made, the insurance company typically pays the remainder of the covered medical charges.

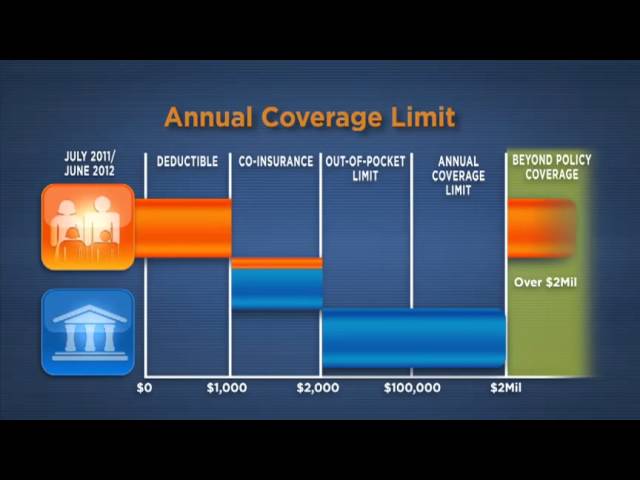

Deductibles: Some plans include a deductible, which typically refers to the amount of money you must pay each year before your health insurance plan starts to pay for covered medical expenses.

Coinsurance: Some plans include coinsurance. Coinsurance is a cost sharing requirement that makes you responsible for paying a certain percentage of any costs. The insurance company pays the remaining percentage of the covered medical expenses after your insurance deductible is met.

Out-of-pocket limit: Some plans include an out-of-pocket limit. Typically, the out-of-pocket limit is the maximum amount you will pay out of your own pocket for covered medical expenses in a given year. The out-of-pocket limit typically includes deductibles and coinsurance. But, out-of-pocket limits don't typically apply to co-payments.

Lifetime maximum: Most plans include a lifetime maximum. Typically the lifetime maximum is the amount your insurance plan will pay for covered medical expenses in the course of your lifetime.

Exclusions & Limitations: Most health insurance carriers disclose exclusions & limitations of their plans. It is always a good idea to know what benefits are limited and which services are excluded on your plan. You will be obligated to pay for 100% of services that are excluded on your policy.

Beginning September 23, 2010, the Patient Protection and Affordable Care Act (health care reform) begins to phase out annual dollar limits. Starting on September 23, 2012, annual limits on health insurance plans must be at least $2 million. By 2014 no new health insurance plan will be permitted to have an annual dollar limit on most covered benefits.

Some health insurance plans purchased before March 23, 2010 have what is called "grandfathered status." Health Insurance Plans with Grandfathered status are exempt from several changes required by health care reform including this phase out of annual limits on health coverage.

If you purchased your health insurance policy after March 23, 2010 and you're due for a routine preventive care screening like a mammogram or colonoscopy, you may be able to receive that preventive care screening without making a co-payment. You can talk to your insurer or your licensed eHealthInsurance agent if you need help determining whether or not you qualify for a screening without a co-payment.

There are five important changes that occurred with individual and family health insurance policies on September 23, 2010.

Those changes are:

1. Added protection from rate increases: Insurance companies will need to publically disclose any rate increases and provide justification before raising your monthly premiums.

2. Added protection from having insurance canceled: An insurance company cannot cancel your policy except in cases of intentional misrepresentations or fraud.

3. Coverage for preventive care: Certain recommended preventive services, immunizations, and screenings will be covered with no cost sharing requirement.

4. No lifetime maximums on health coverage: No lifetime limits on the dollar value of those health benefits deemed to be essential by the Department of Health and Human Services.

5. No pre-existing condition exclusions for children: If you have children under the age of 19 with pre-existing medical conditions, their application for health insurance cannot be declined due to a pre-existing medical condition. In some states a child may need to wait for the state's open-enrollment period before their application will be approved.

How to choose a plan in the Health Insurance Marketplace

When you compare Marketplace insurance plans, they're put into 5 categories based on how you and the plan can expect to share the costs of care: Bronze, Silver, Gold, Platinum, and Catastrophic. The category you choose affects how much your premium costs each month and what portion of the bill you pay for things like hospital visits or prescription medications. Visit HealthCare.gov to see if you can get coverage outside Open Enrollment: http://hlthc.re/R6AlFe

Find Affordable Health Coverage Today

Open Enrollment is now over. See if you can still get coverage: https://www.healthcare.gov/screener/.

—

U.S. Department of Health and Human Services (HHS)

http://www.hhs.gov

We accept comments in the spirit of our comment policy:

http://www.hhs.gov/web/socialmedia/policies/comment-policy.html

HHS Privacy Policy

http://www.hhs.gov/Privacy.html

Health Reform Explained Video: “Health Reform Hits Main Street”

Watch the newest YouToons video (released Nov. 11, 2014), Health Insurance Explained – The YouToons Have It Covered: http://youtu.be/-58VD3z7ZiQ

—–

Health care reform explained in "Health Reform Hits Main Street."

Confused about how the new health care reform law really works? This short, animated movie — featuring the "YouToons" — explains the problems with the current health care system, the changes that are happening now, and the big changes coming in 2014. Written and produced by the Kaiser Family Foundation. Narrated by Cokie Roberts, a news commentator for ABC News and NPR and a member of Kaiser's Board of Trustees. Creative production and animation by Free Range Studios.

Also let the YouToons illustrate how health insurance coverage will work under reform. Visit: http://healthreform.kff.org/profiles.aspx